Related

Stacked Income Protection (STAX & STAX-HPE)

Overview

STAX is an area-based coverage available for election on Cotton (0021) that provides coverage for up to 20% of the expected area revenue for an insured’s area. STAX coverage can be a stand-alone policy or a companion to a standard MPCI (Plan 01, 02, or 03) or ARPI (Plan 04, 05, or 06) policy.

RMA has two plans for STAX: 35 (RP) and 36 (RP-HPE). CAT coverage is not available for a STAX stand-alone policy, but if the companion policy is at the CAT level, STAX coverage is available for purchase at the CAT level.

The amount of STAX coverage depends on the Expected Yield, Projected Price, Coverage Range, and Protection Factor. The Expected Yield for STAX is based on the historical average of yields in the county as reported to RMA by insured growers. If data is insufficient in the county for which coverage is requested, the RMA averages the yields of surrounding counties until sufficient data is available to determine expected yields and premium rates.

Indemnities are due when the final area revenue for the insured crop is less than the Area Loss Trigger on the STAX coverage. Indemnities are not paid until the revenue falls below the Area Loss Trigger.

| • | STAX is a continuous policy. If a new Area Loss Trigger, Protection Factor, and/or Coverage Range is not selected on or before the SCD, the same values from the previous Reinsurance Year will apply to the current Reinsurance Year. |

| • | Replanting and Prevented Planting payments are not provided under STAX. Late Planting, Added Land, and Written Agreements are not available either; however, if a companion policy exists, Added Land or a Written Agreement can apply to that policy. |

| • | STAX may be purchased in combination with SCO; however, the same acreage cannot be insured under both policies and all acreage must be insured by the same AIP. |

| • | An APH database can be maintained for a stand-alone and companion policies: |

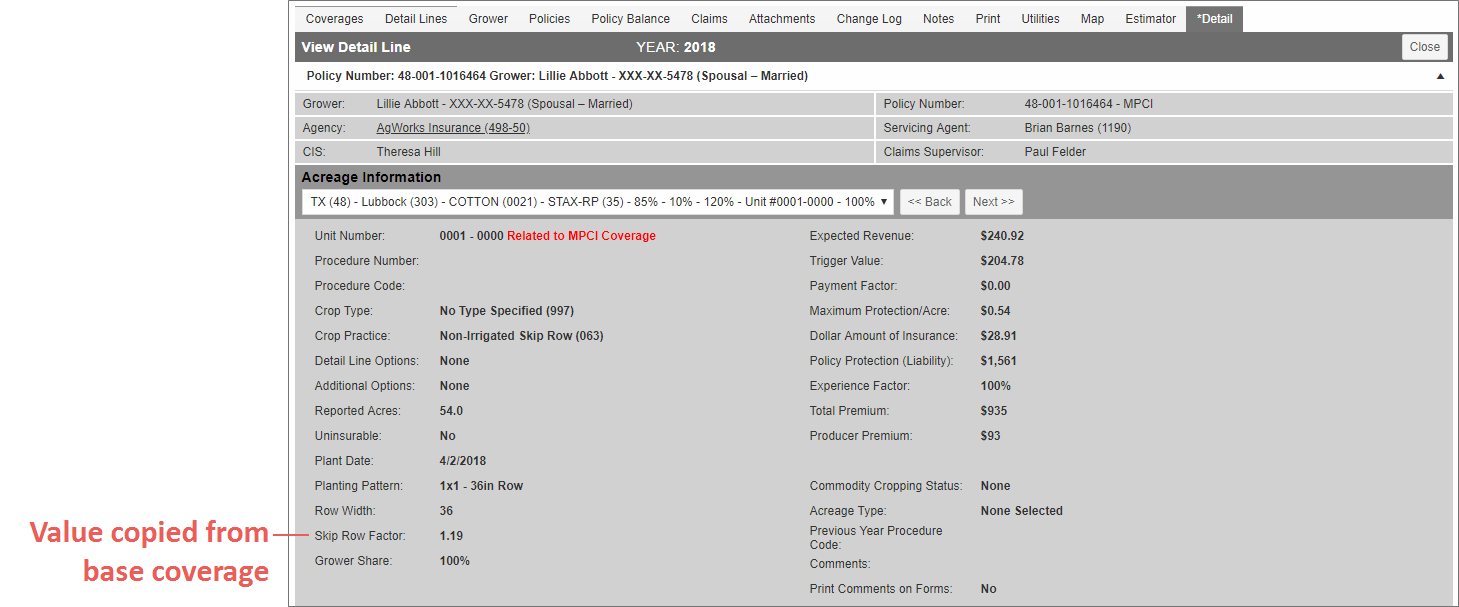

| • | For a STAX companion policy, the MPCI detail line and STAX detail line are linked when the STAX detail line is created. The APH database will be pulled from the underlying linked MPCI coverage. However, because current year production is required to be reported on STAX (similar to ARPI), an eleventh year will be available in an editable format on the APH database. |

| • | For a STAX standalone policy, an eleven-year APH database will be available (11th year is current year acres and production) for entry. The user will enter the database just as they would for MPCI, but as it is for record keeping purposes only, the validations and calculations are not applicable. |

| • | A separate Administrative Fee will be charged for a STAX policy ($30). This fee may be waived if the insured qualifies as a Limited Resource Farmer or Beginning Farmer/Rancher. |

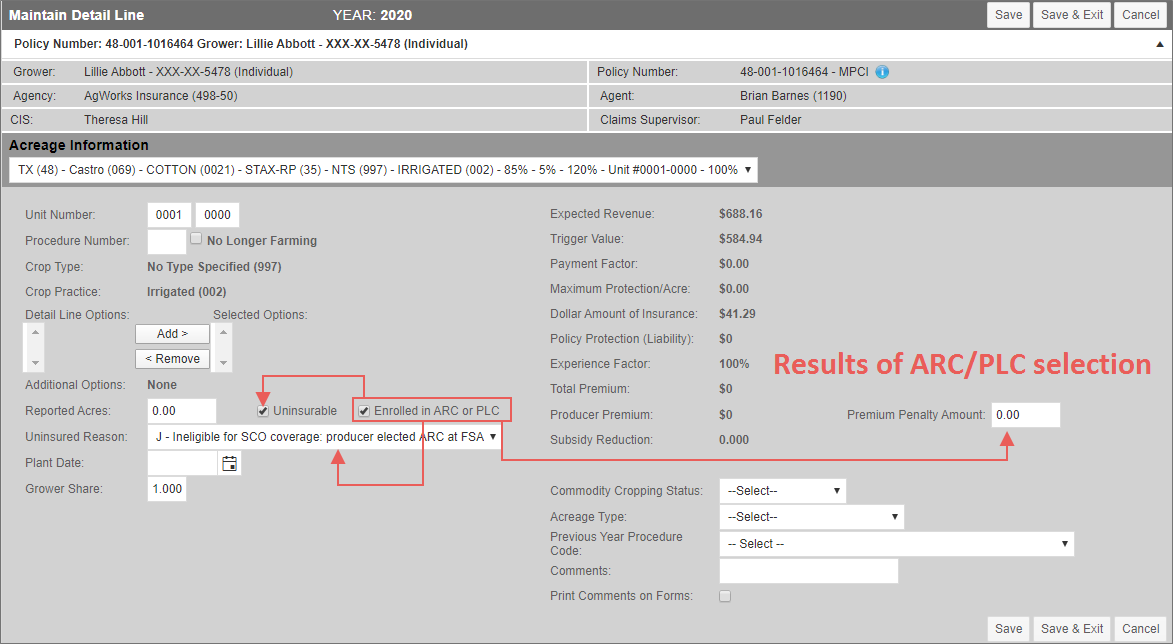

| • | For the 2020+ RYs, the RMA is assessing a penalty when STAX is elected on a coverage and found to be enrolled in ARC or PLC since the same FSN cannot have both. To offset the cost incurred by the AIP in servicing STAX policies, the following penalties will apply by FSN for STAX acreage that was reported as insurable but later determined to be enrolled in ARC or PLC and therefore, uninsurable: |

| • | The acreage for the FSN(s) will be void, |

| • | No indemnity will be payable, and |

| • | The insured is required to pay 60 percent of the premium due. |

| • | The SE endorsement is available where specified in the actuarial documents. |

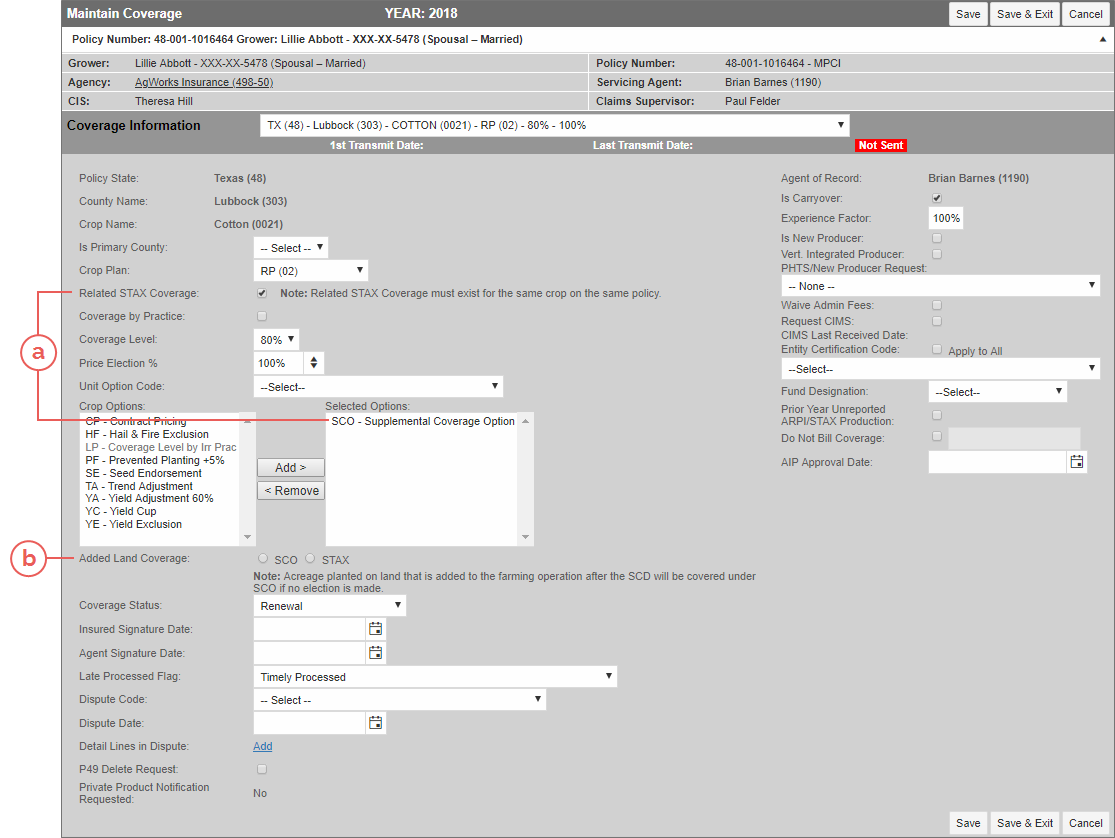

If a YP (01), RP (02), or RPHPE (03) companion policy has SCO elected on the base coverage and the Related STAX Coverage checkbox is marked on the base coverage (a), an Added Land Coverage field displays below the Options grids (b).

This new field contains two options, “SCO” and “STAX”, to allow a user to indicate which policy applies to land that is added to the farming operation after the Production Reporting Date (but before the Acreage Reporting Date). If no selection is made, the System defaults to “SCO”.

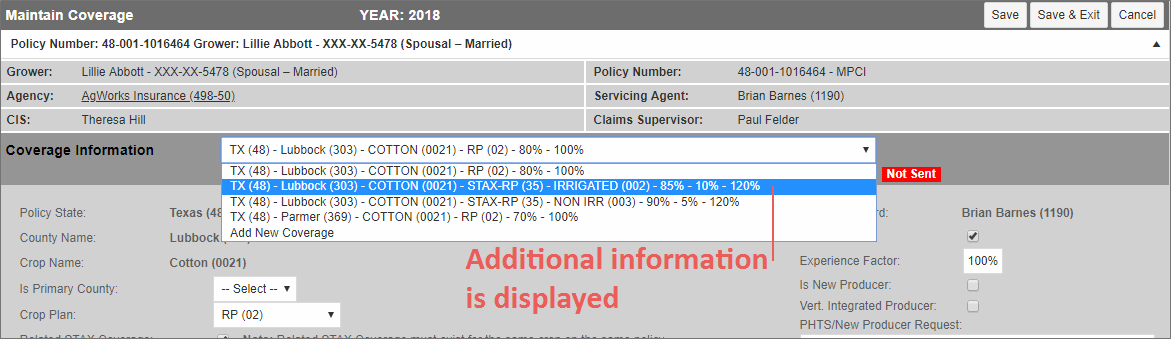

The Coverage Information dropdown is displayed on many pages in the System (e.g., View/Maintain Coverage and View MPCI Detail Lines).

| • | State Abbreviation and Code |

| • | County Name and Code |

| • | Crop Abbreviation and Code |

| • | Plan Abbreviation and Code |

| • | Type Abbreviation and Code (if applicable) |

| • | Practice Abbreviation and Code (if applicable) |

| • | Area Loss Trigger % |

| • | Coverage Range % |

| • | Protection Factor % |

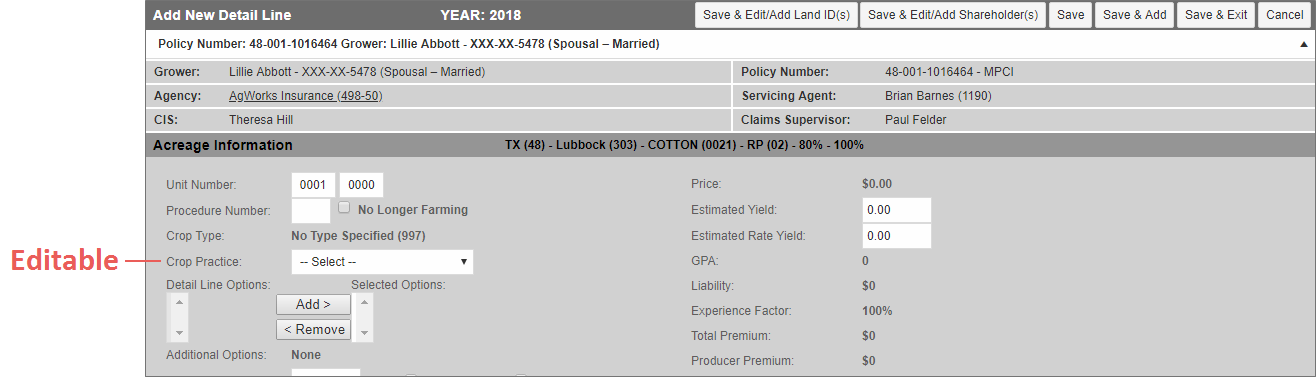

For STAX stand-alone policies, the Practice field is editable on the Add New/Maintain Detail Line page so a user can edit the Practice for a detail line when no Practice was selected for the coverage.

NOTE: When the STAX coverage is a zero coverage, the system will automatically set the detail lines to uninsurable and set the non-premium acreage code to “E” when acres are keyed.

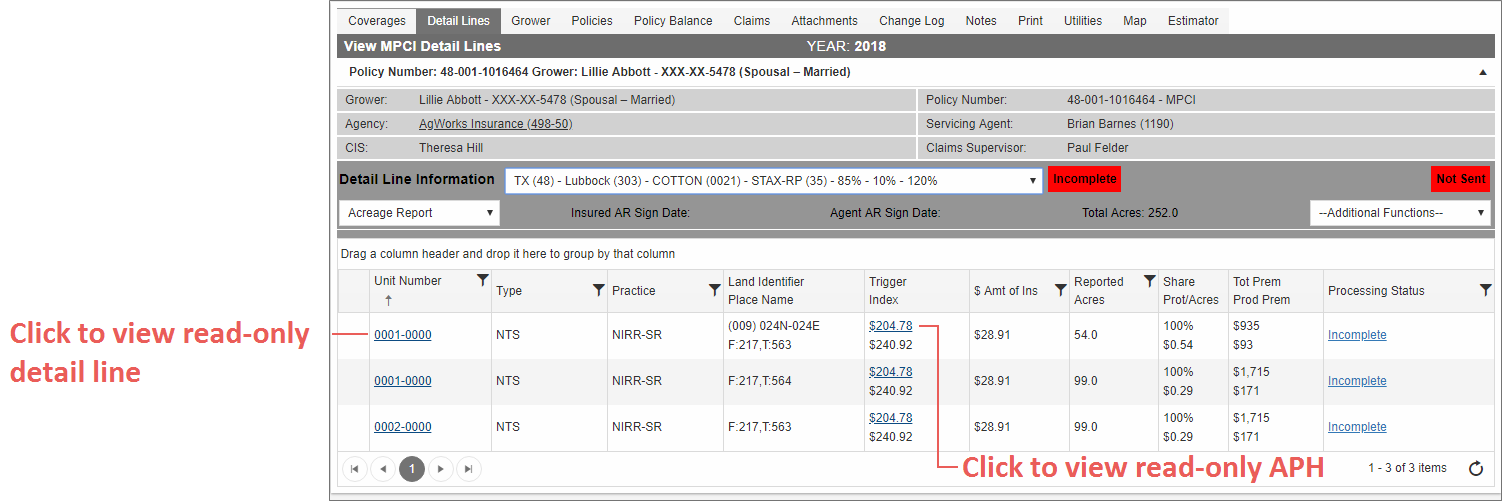

On STAX detail lines, the followings fields specific to STAX (Plans 35 and 36) will display in addition to the usual fields seen for Cotton detail lines. The values for these fields are calculated on save of the detail line:

The Expected/Final Area Yield for all calculations below is “Expected/Final Index Value” in the ADM (A01005).

| a. | Expected Revenue: |

| • | For Plan 35, this value is the Expected Area Yield x higher of Projected or Harvest Price. |

| • | For Plan 36, this value is the Expected Are Yield x Projected Price. |

| b. | Trigger Value: |

| • | For Plan 35, this value is the Expected Revenue x Area Loss Trigger or Expected Area Yield x higher of Projected or Harvest Price x Area Loss Trigger. |

| • | For Plan 36, this value is the Expected Revenue x Area Loss Trigger or Expected Area Yield x Projected Price x Area Loss Trigger. |

| c. | Payment Factor: |

| • | For Plan 35, this value is the [Area Loss Trigger – (Final Area Revenue/(Expected Area Yield x higher of Projected or Harvest Price))]/Coverage Range. |

| • | For Plan 36, this value is the (Area Loss Trigger – (Final Area Revenue/Expected County Revenue))/Coverage Range. |

NOTE: This value will not be calculated until the Harvest Price and Final Expected Yield (Final Area Revenue) are released. Payment Factor is limited to a maximum of 1.0000.

| d. | Maximum Protection/Acre: |

| • | For Plan 35, this value is the Expected Area Yield x higher of Projected or Harvest Price x Coverage Range x Protection Factor x Share %. |

| • | For Plan 36, this value is the Expected Area Yield x Projected Price x Coverage Range x Protection Factor x Share %. |

| e. | Dollar Amount of Insurance: |

| • | For Plan 35, this value is the Expected Area Yield x higher of Projected or Harvest Price x Coverage Range x Protection Factor. |

| • | For Plan 36, this value is the Expected Area Yield x Projected Price x Coverage Range x Protection Factor. |

| f. | Policy Protection (Liability): |

| • | For Plan 35, this value is the Expected Area Yield x higher of Projected or Harvest Price x Coverage Range x Protection Factor x Acres x Share %. |

| • | For Plan 36, this value is the Expected Area Yield x Projected Price x Coverage Range x Protection Factor x Acres x Share %. |

Since changes cannot be made to the Related STAX Coverage, the Save, Save & Exit, and Cancel buttons were removed.

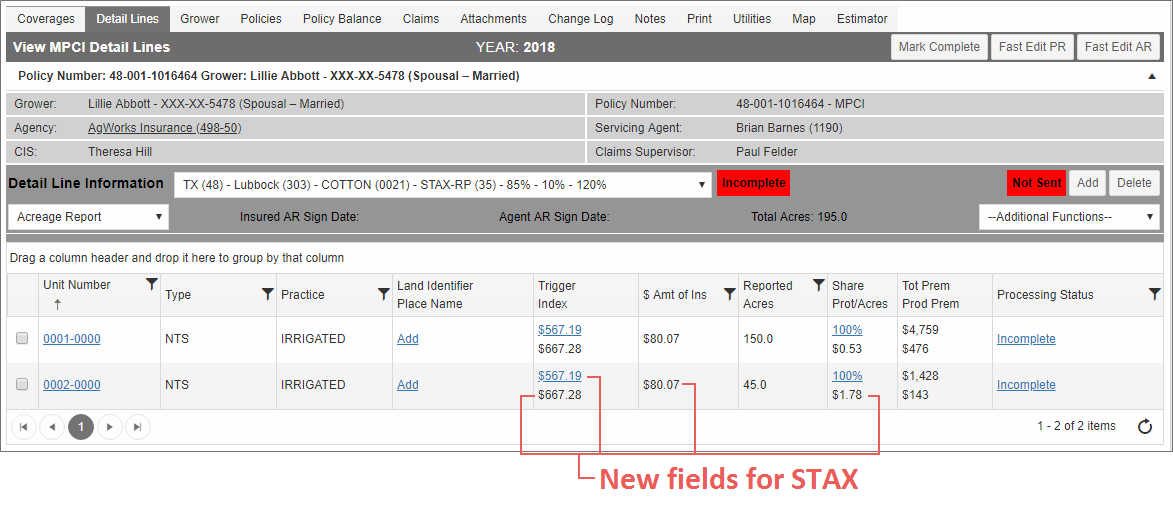

On the Detail Lines tab, the followings fields specific to STAX (Plans 35 and 36) will display in addition to the usual fields seen for Cotton detail lines: Trigger, Index, $ Amt of Ins, and Prot/Acres.

These are the same values calculated and displayed within the Maintain Detail Line page.

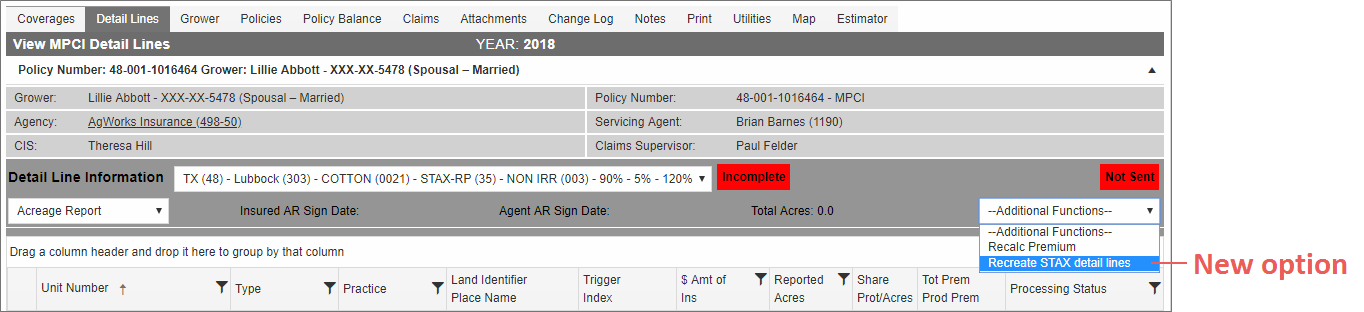

Additionally, these changes were made to the View MPCI Detail Lines tab to accommodate STAX:

| • | The Fast Edit AR button is no longer available. |

| • | The Add and Delete buttons were removed. |

| • | In the Additional Functions dropdown, the Process Zero AR option was removed. An additional option, “Recreate STAX Detail Lines”, option is available. If selected, the System will delete all STAX detail lines from the coverage and immediately recreate them from the Related MPCI coverage. This option is to be used if there were multiple changes made to the Related Coverage(s) and/or the Related MPCI detail lines that have resulted in Related STAX detail lines not creating, updating, or being removed as they should. |

| • | The checkbox to select detail lines has been removed. |

| • | The Share hyperlink is not available; the field is read only. |

Processing Status

A detail line for STAX (Plans 35 or 36) is complete when either:

| • | The Insurable Reported Acres field is greater than zero (0) and the following exist on the detail line: |

| • | Basic Unit # greater than 0000; |

| • | A Unit Structure of "BU"; |

| • | Type and Practice; |

| • | A Share greater than zero (0); |

| • | A Current RY Expected County Value |

| • | A Current RY ADM Project Price or Harvest Price (if Plan 35) or a Current RY ADM Projected Price if Plan 36; and |

| • | Original Agent and Insured Signature Dates (these must be applied to the STAX coverage via the Maintain Signature page or the Fast Edit AR page from within the underlying policy). |

| • | The Reported Acres field is zero (0) or if acres are greater than zero (0) but the Uninsurable checkbox is marked and the following exist on the detail line: |

| • | Basic Unit # greater than 0000; |

| • | A Unit Structure of "BU"; |

| • | Type and Practice; |

| • | A Share greater than zero (0); |

| • | A Non-Premium Acreage Code (if Uninsurable Acres are greater than zero); and |

| • | Original Agent and Insured Signature Dates (these must be applied to the STAX coverage via the Maintain Signature page or the Fast Edit AR page from within the underlying policy). |

The STAX APH/Production Reporting is not completely implemented in the System; this will be done with TFS #20386 in a later release. Changes made thus far are relevant to companion policies where both STAX and SCO have been elected on a coverage.

For a YP (01), RP (02), or RPHPE (03) plan companion policy, when the Related STAX Coverage checkbox is marked and SCO has been elected as an option on the coverage, then in the APH, a Related Coverage field is displayed so a user can designate (by Production Reporting Date) if the insurable, planted acres for that unit will be covered under SCO or STAX. If the STAX checkbox is marked here, an SCO child detail line will not be created if insurable, planted acres are reported on this unit. If SCO is selected, an SCO child line is created and a STAX detail line will not be created on the related STAX coverage. (The STAX detail line functionality will be available with TFS #17860 in a later release.) The System will display a warning upon save if these STAX and Added Land are selected together. If no selection is made in the Related Coverage field, the System will default to “SCO”.

If the APH has an Added Land APH Override (“Added Land – Simple Average”, “Added Land – Reference Unit”, or “Added Land – Variable T-Yields”) and the user selects a different coverage than the Added Land Related Coverage selected on the coverage page, the System will display a warning; if no selection is made, the System will default to the Added Land Related Coverage selected on the coverage record.

As a result of the STAX functionality, the SCO APH functionality has been updated similarly. See "SCO & THE APH WHEN STAX IS ON THE POLICY" for more information.

When the Enrolled in ARC/PLC checkbox is selected on the Add New/Maintain Detail Line pages, a Premium Penalty Amount field displays. In this field, if an insured is found to be uninsurable due to ARC or PLC enrollment but the plan type is STAX (35 or 36), then they must be assessed the 60% premium penalty.

For each applicable unit, users must calculate this value and key it into the Premium Penalty Amount field.

NOTE: It’s recommended users allow the System to calculate the standard STAX premium amount before selecting the Enrolled in ARC (or PLC) checkbox and then use that value to determine the 60% premium reduction.

The keyed Premium Penalty Amount will carry over to Policy Balance and Premium Statements but will not be included on MPCI policy forms such as the Schedule of insurance.

|

Want to learn more? |

|