Related

Hurricane Insurance Protection - Wind Index (HIP-WI)

Overview

Full HIP-WI functionality is being implemented over several releases. This topic will be updated as additional functionality is made available in the System.

Hurricane Insurance Protection Wind Index Endorsement (HIP-WI) (Plan 37) is a new crop insurance product developed by RMA in response to a 2018 Farm Bill requirement. HIP-WI began being offered for the 2020+ RY as an endorsement to individual crop policies under the Common Crop Insurance Policy Basic Provisions (BP) per the actuarials.

HIP-WI provides coverage for a portion of the underlying crop insurance policy deductible when the county or an adjacent county is subjected to sustained hurricane force winds within its boundaries according to National Oceanic and Atmospheric Administration (NOAA). An underlying crop policy that falls under the Common Crop Insurance Policy’s Basic Provisions (BP) must be in force to elect this endorsement.

NOTE: If a hurricane hits prior to the Acreage Reporting Date (ARD) + 14 days, the number of eligible acres is reduced and a HIP Acre Limitation Factor is applicable and premium/liability is reduced.

This new option is similar to the Supplemental Coverage Option (SCO) as it will cover the deductible portion of the MPCI policy, up to a 95% of crop value.

NOTE: When combined with SCO or STAX, HIP-WI covers a portion of the deductible above the SCO or STAX layer of insurance, up to 95% of the expected crop value.

For the 2020 RY

The HIP-WI Endorsement has a Sales Closing Date of April 30, 2020. Subsequent Sales Closing Dates will match the SCD for the underlying MPCI policy. There will be a 14-day waiting period for new policies and/or if changes are made to an existing coverage in subsequent years. With this option, the premium subsidy will be fixed at 65% (same as SCO). If a hurricane occurs during the insurance period, the insured will receive a payment.

NOTE: For the 2020 RY only, where the end of insurance period is before the end of the hurricane season and prior to the beginning of the insurance period for the next crop year, a gap or "HE" option is available to allow producers of certain crops to purchase an option to cover the time period gap of coverage between the end of insurance period and the beginning of the new crops year's insurance period.

For the 2021+ RYs

For 2021+ RYs, RMA has updated the procedures around the HIP Acre Limitation as follows:

| • | If it is the initial year of HIP coverage: |

| • | For Nursery, Nursery Value Select and Tree Crops, coverage does not attach the initial year until after the SCD + 14 days or the waiting period on the underlying policy, therefore there would not be coverage in this scenario the initial year. |

| • | For all other crops, acres are limited to the lesser of intended acres or total acres planted at the time of the triggering event. |

| • | If it is a subsequent year of HIP coverage: |

| • | For Nursery, Nursery Value Select and Tree Crops, coverage will be limited to the lesser of the prior year amount of insurance or the amount of insurance in the current year. |

| • | For all other crops, acres are limited to the lesser of the greatest acres in the previous four years or total acres planted at the time of the triggering event. |

Consult the actuarial documents for HIP-WI availability and Sales Closing Dates by state/county/crop.

HIP-WI is available with all plan codes that are allowed under the Common Crop Insurance Policy Basic Provisions:

| • | ARH (Plan 47): Oranges- 0227 (47) |

| • | APH (Plan 90 - Category C): Apples- 0054 (90), Avocados-0019 (90), Banana- 0255 (90), Blueberries- 0012 (90), Coffee- 0256 (90), Cranberries- 0058 (90), Grapefruit- 0201 (90), Grapes- 0053 (90), Lemons- 0202 (90), Macadamia Nuts- 0023 (90), Mandarins/Tangerines- 0309 (90), Oranges- 0227 (90), Papaya- 0257 (90), Peaches- 0034 (90), Tangelos- 0203 (90) |

| • | Aquaculture (Plan 43): Clams- 0116 (43) |

| • | Dollar Amount of Insurance (Plan 50) (Excluding Nursery & NVS): Forage Seeding- 0032 (50), Fresh Market Sweet Corn- 0044 (50), Fresh Market Potatoes- 0086 (50), Grapefruit- 0201 (50), Lemons- 0202 (50), Limes- 9936 (50), Mandarins/Tangerines- 0309 (50), Oranges- 0227 (50), Peppers- 0083 (50), Tangelos- 0203 (50), Tangors- 1302 (50) |

| • | Dollar Amount of Insurance (Plan 50) (Nursery & NVS): Nursery (FG&C)- 0073 (50), Nursery Value Select (NVS)- 1010 (50) |

NOTE: HIP is not allowed with the OW crop option on NVS coverages or the PEAK endorsement on Nursery.

| • | Pecan Revenue (Plan 41): Pecans-0020 (41) |

| • | STAX (Plans 35 and 36 - but not on Standalone STAX): Cotton- 0021 (35, 36) |

| • | Tree Based Dollar Amount of Insurance (Plan 40)): All Other Citrus Trees- 0211 (40), Apple Trees- 0184 (40), Avocado Trees- 0212 (40), Banana Tree- 0265 (40), Coffee Tree- 0266 (40), Carambola Trees- 0213 (40), Grapefruit Trees- 0208 (40), Lemon Trees- 0209 (40), Lime Trees- 0210 (40), Macadamia Trees- 0024 (40), Mango Trees- 0214 (40), Orange Trees- 0207 (40), Papaya Tree- 0267 (40), Pecan Trees- 0284 (40), Tangerine Trees- 0193 (40) |

NOTE: HIP-WI Endorsement is allowed with Plan 40 (Tree based Dollar Amount); however it is not allowed in conjunction with Plan 40 with the Option Codes List "CV", "OW", or "OX".

| • | Yield Based Dollar Amount of Insurance (Plan 55): Hybrid Corn Seed- 0062 (55), Hybrid Seed Rice- 0080 (55) |

| • | Yield Protection (Plan 01), Revenue Protection (Plans 02 & 03), & APH (Plan 90 Category B): Barley- 0091 (01, 02, 03), Burley Tobacco- 0231 (90), Cabbage- 0072 (90), Canola-0015 (01, 02, 03), Cigar Binder Tobacco- 0235 (90), Cigar Filler Tobacco- 0234 (90), Cigar Wrapper Tobacco- 0236 (90), Clary Sage- 0079 (90), Corn- 0041 (01, 02, 03), Cotton- 0021 (01, 02, 03), Cotton Ex Long Staple- 0022 (90), Cucumbers- 0132 (90), Dark Air Tobacco- 0233 (90), Fire Cured Tobacco- 0230 (90), Flue Cured Tobacco- 0229 (90), Forage Production- 0033 (90), Fresh Market Beans- 0105 (90), Fresh Market Tomatoes- 0086 (90), Grain Sorghum- 0051 (01, 02, 03), Green Peas- 0064 (90), Hemp- 1218 (90), Maryland Tobacco- 0232 (90), Oats-0016 (90), Onions-0013 (90), Peanuts- 0075 (01, 02, 03), Potatoes- 0084 (90), Processing Beans- 0046 (90), Rice-0018 (01, 02, 03), Rye- 0094 (90), Sesame- 0396 (90), Soybeans- 0081 (01, 02, 03), Sugarcane- 0038 (90), Sunflowers- 0078 (01, 02, 03), Sweet Corn- 0042 (90), Sweet Potatoes- 0156 (90), Tomatoes- 0087 (90), Wheat- 0011 (01, 02, 03) |

NOTE: HIP-WI is NOT applicable with ARPI (Plans 04, 05, and 06), Margin Protection (Plans 16 and 17), Rainfall Index (13), WFRP (76), or when STAX is a standalone policy.

| • | The HIP-WI Endorsement must be purchased from the same insurance provider as the underlying policy. |

| • | The guarantee is established using information from the underlying policy. Since there are no units for HIP-WI, policy protection is based on all planted acres (annual crops), insurable acreage (perennials), and dollar amount of insurance (tree crops and nursery) of the crop in the county insured by the underlying policy, with the exception of Prevented Planting and Replant acres. |

| • | If there are multiple coverage levels, types or practices for the insured crop in the county, the HIP-WI protection amount will be determined separately for acres or plans insured at each coverage level, type, and practice. |

| • | HIP-WI can be combined with Supplemental Coverage Option (SCO) and Stacked Income Protection (STAX) (but not standalone STAX). |

| • | Any premium and/or indemnity reductions are made on the underlying policy, they will also apply to the HIP-WI Endorsement. |

| • | The HIP-WI Endorsement is available for CAT and additional coverage policies when provided on the actuarial documents. |

| • | Separate Premium and Admin Fees will be due for the HIP-WI Endorsement in addition to the fees of the underlying policy. However, the HIP-WI Admin Fee may be waived if the producer qualifies for Limited Resource Farmer, BFR, or VFR. |

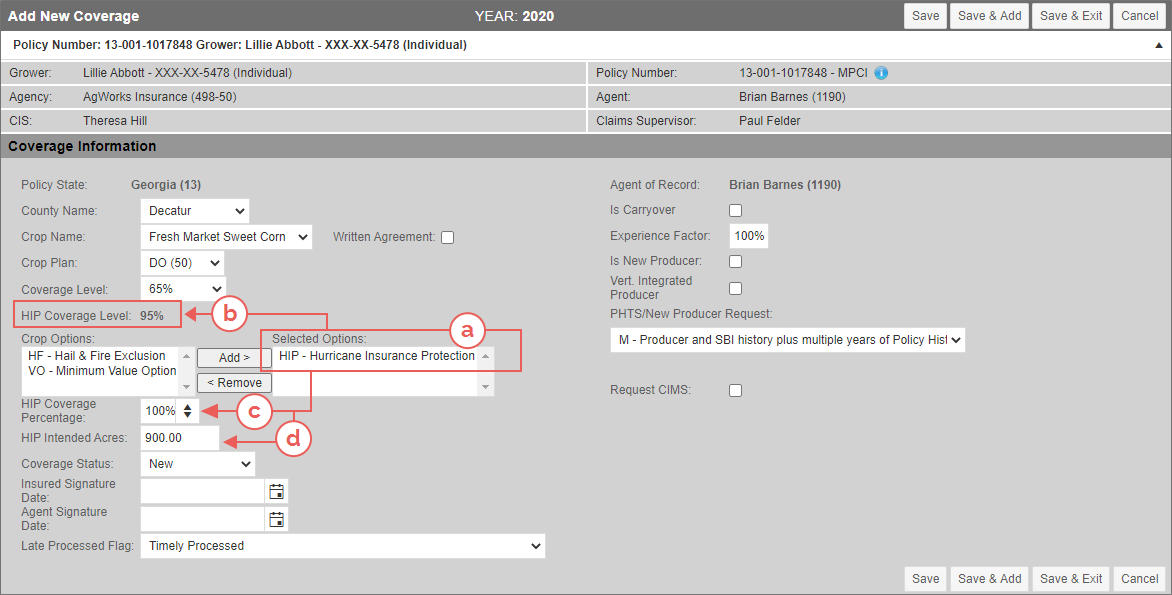

When available for the state/county/crop, the "HIP - Hurricane Income Protection" option is available for selection in the Crop Options when adding a new coverage. When HIP is selected, the additional HIP fields display (a):

NOTE: For the 2020 RY only, where the end of insurance period is before the end of the hurricane season and prior to the beginning of the insurance period for the next crop year, a gap or "HE" option is available to allow producers of certain crops to purchase an option to cover the time period gap of coverage between the end of insurance period and the beginning of the new crops year's insurance period. This option should be elected with "HIP".

| • | The HIP Coverage Level field displays (read-only, always as 95%) above the Crop Options (b). |

| • | The HIP Coverage Selection spinner displays. This field defaults to 100% but can be values between 1-100 (c). |

| • | The HIP Intended Acres field displays (d) for the user (the AIP user in the 2020 RY and AIP or Agent user in subsequent years) to key the intended acres for the current year at the HIP SCD when the underlying coverage's Acreage Reporting Date has already passed. This value is stored by the System for use with claims (if needed) but is not used in premium calculations, printed on forms, or transmitted to RMA. There is no restriction around the intended acres being changed once they are entered/saved. Standard agent lock out that applies to the coverage page will apply to this field. This field is optional. |

NOTE: The HIP option cannot be selected if STAX is a stand-alone coverage. If the Related Coverage checkbox has not been selected on the STAX coverage, the System will notify you that the STAX coverage cannot have HIP-WI.

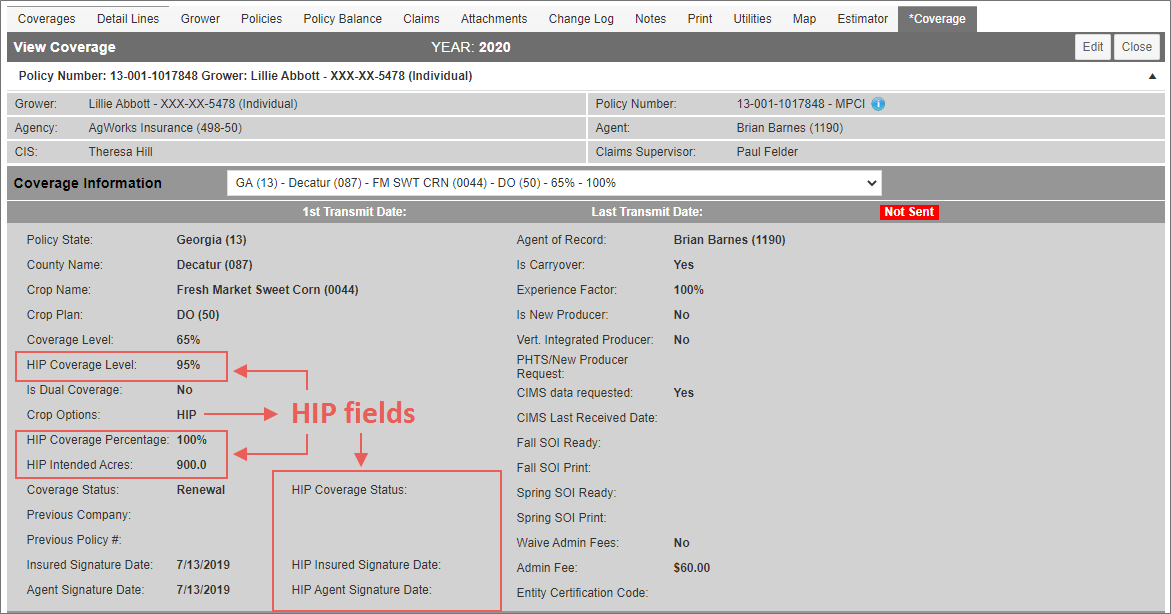

The View Coverage page displays this same information as read only.

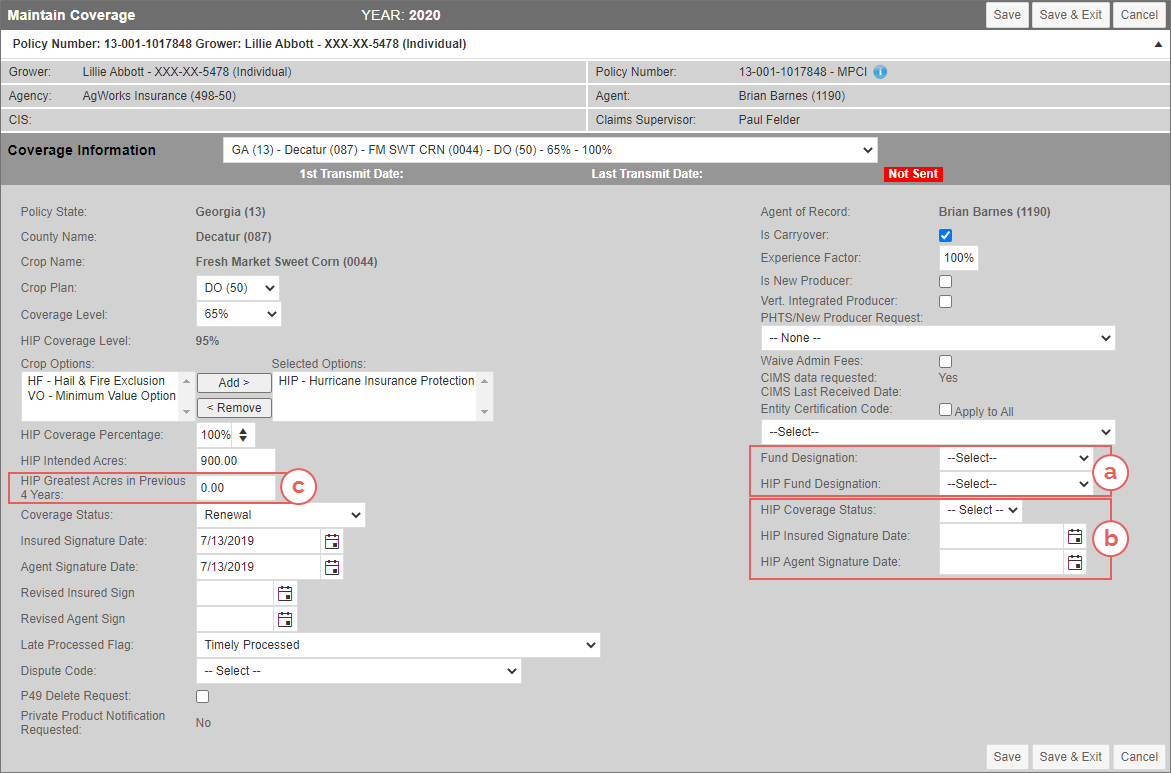

The Maintain Coverage page displays this same information HIP election fields as Add New and View Coverage pages but also adds additional HIP-specific fields for Fund Designation (with proper permissions), Coverage Status, and Insured and Agent Signature Dates. The Coverage Status and HIP Sign Dates will populate at save when HIP is added as an option (instead of adding revised coverage dates for underlying coverage to capture the HIP application).

Also, if no Intended Acres are keyed, an AIP user can key the highest number of acres planted in any one of the immediate past four crops years to be used in place of intended acres; this value is keyed on the Maintain Coverage page in the HIP Greatest Acres in Previous 4 Years’ field. This value should only be keyed if the determined value is less than reported acres in the current RY and a claim exists.

NOTE: Per Manager’s Bulletin MGR 20-011, if a hurricane hits prior to the ARD + 14 days, the number of eligible acres will be the lesser of the HIP Intended Acres (or when not reported, the highest number of acres planted in the last 4 years) or the Total Reported HIP Acres for the current year.

NOTE: HIP Intended Acres and HIP Greatest Acres in Previous 4 Years' fields are not available for Plan 40 crops or most plan 50.

for Nursery, Nursery Value Select and Tree Crops only

A Prior Year Amount of Insurance will display for Nursery, Nursery Value Select and Tree Crops only. This value must be manually determined by the user and is necessary to apply the HIP Limitation should a hurricane occur before the insured provides their Acreage Report, Plant Value Inventory Report, and Nursery Value Report.

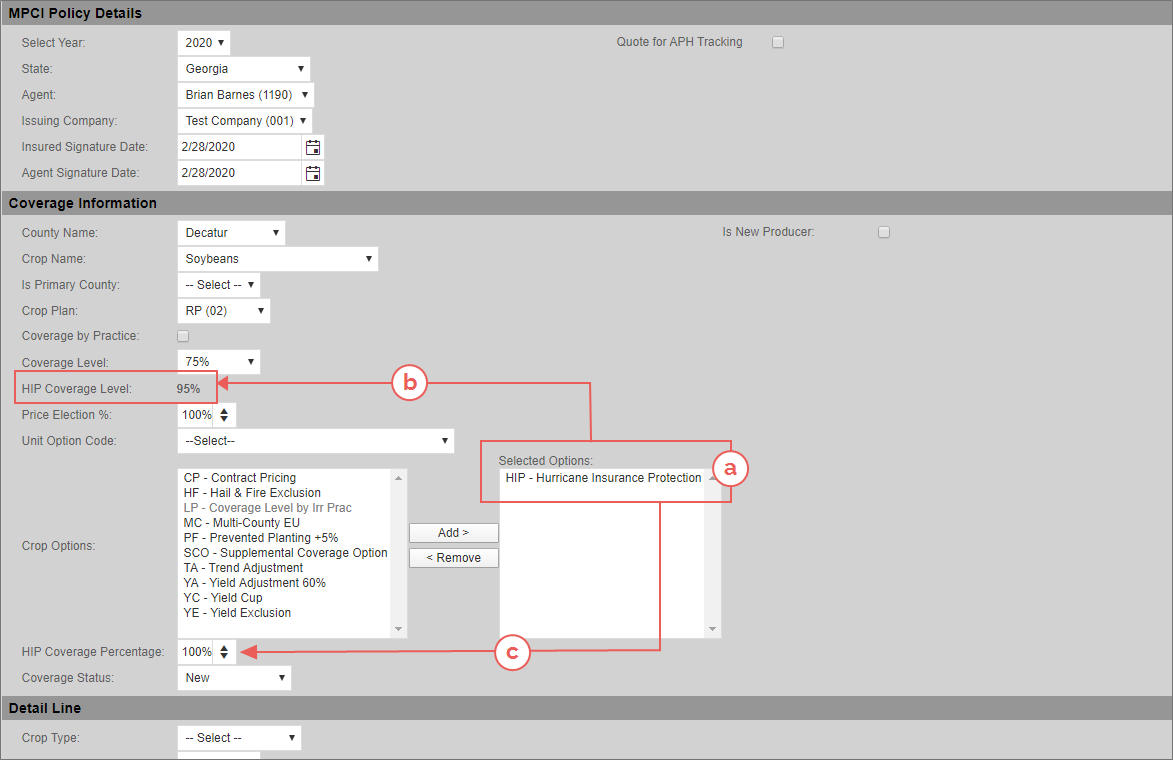

In the Coverage Information section, when available for the state/county/crop, the "HIP - Hurricane Income Protection" option is available for selection in the Crop Options. When selected (a), the following fields display:

| • | The HIP Coverage Level field displays (read-only, always as 95%) above the Crop Options (b). |

| • | The HIP Coverage Selection spinner displays. This field defaults to 100% but can be values between 1-100 (c). |

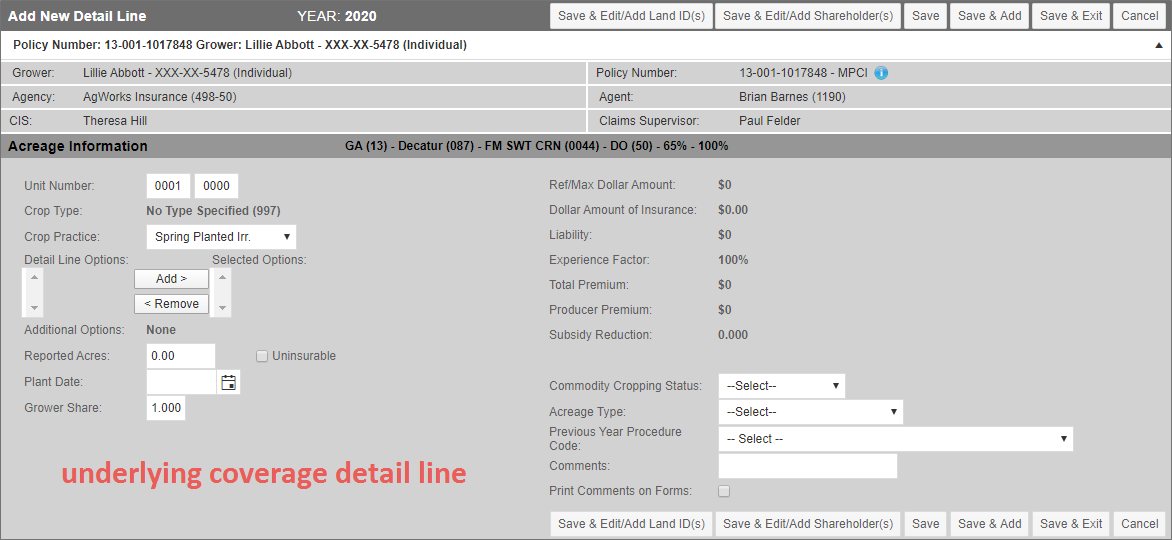

An MPCI detail line (parent) must exist for the underlying MPCI coverage and must have a planted, insurable acre value entered or the equivalent (for example, a PIVR for Nursery) before the System will generate a read-only child line for the HIP-WI option.

NOTE: HIP-WI is not allowed on Prevented Planting or Replant acres.

When Detail Lines have been created for the underlying coverage, they are displayed on the Detail Lines tab. The HIP-WI child lines do not appear until acreage has been keyed and saved via Fast Edit AR or the Maintain Detail Lines page.

NOTE: Child lines are not allowed on Plan 40 detail lines that have the "CV", "OW", or "OX" crop options and will not be created by the System.

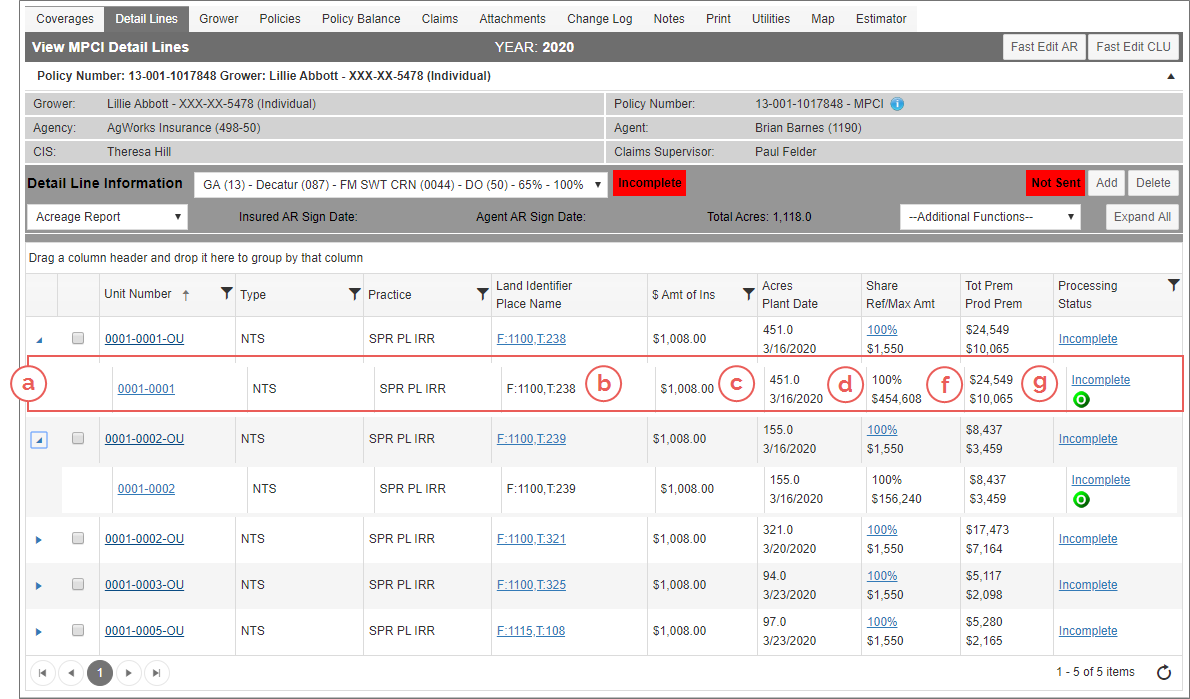

Above, acreage was keyed and saved, and the child line now displays below it's parent line.

| a. | The HIP-WI child lines created upon save of the MPCI detail line values cannot be deleted. |

| b. | The Land ID field displays the Land ID from the associated MPCI detail line as read only. |

| c. | For STAX child lines, the Trigger Index column displays the Total Guarantee as the top value and the Hurricane Protection Amount (HPA) for the bottom value. |

| d. | The App’d Yield field displays the read-only Expected Commodity Value that was calculated on save of the keyed MPCI acreage. |

| • | For Plan 41 (Pecan Revenue), the Amount of Insurance field will instead display the Expected Commodity Value. |

| • | For Plan 50 (Nursery (FG & C) and Nursery Value Select (NVS)), the Amount of Insurance field will instead display the Expected Commodity Value. |

| • | For Plans 35 & 36 (STAX, not standalone), the Amount of Insurance field will instead display the Expected Commodity Value. |

| e. | The Guar/Acre field displays the read-only Hurricane Protection Amount (HPA) that was calculated on save of the keyed MPCI acreage. |

| • | When the coverage is Plan 40 (Tree Based Dollar Amount of Insurance), the Ref/Max Amt field will instead display the Hurricane Protection Amount (HPA) value. |

| • | When the coverage is Plan 41 (Pecan Revenue), the App’d Revenue field will instead display the Hurricane Protection Amount (HPA) value. |

| • | When the coverage is Plan 50 (Nursery (FG & C) and Nursery Value Select (NVS)), the Inventory Value/Selected Value field will instead display the Hurricane Protection Amount (HPA) value. |

| f. | The Tot Premium field displays the read-only Total Premium value that was calculated on save of the keyed MPCI acreage. |

| g. | The Prod Premium field displays the read-only Producer Premium value that was calculated on save of the keyed MPCI acreage. |

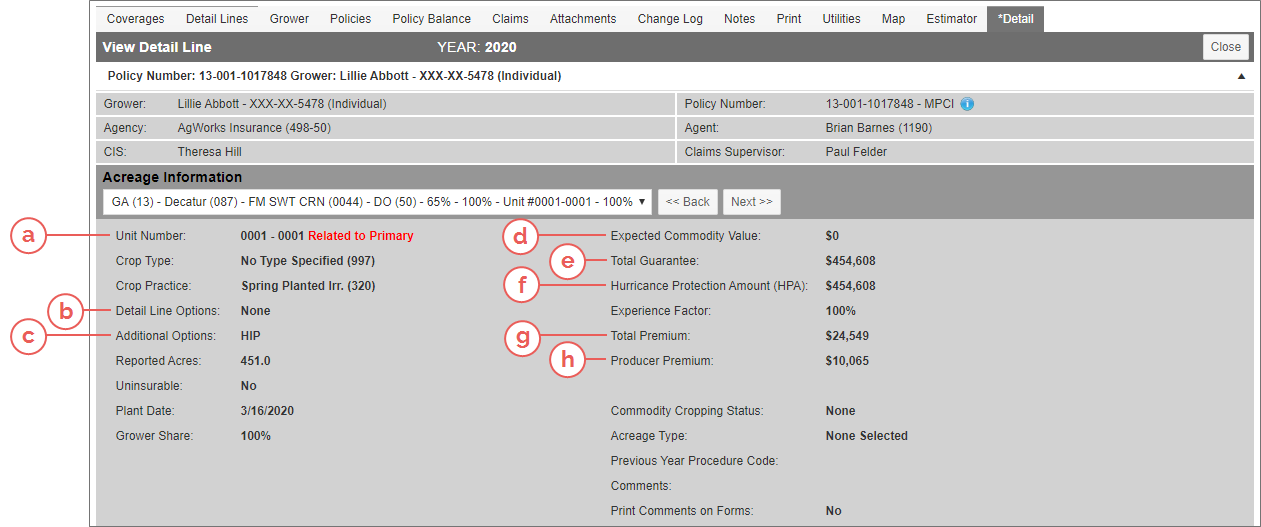

After the underlying coverage's acreage has been reported, the corresponding HIP-WI detail line (child line) is created and can be viewed by clicking the unit number link on the View Detail Lines page. Detail Lines will not display for HIP-WI until acreage is keyed on the underlying MPCI coverage.

The HIP-WI child line records will update with any subsequent changes to the underlying MPCI parent line:

| • | If reported acres on the parent detail lines are removed or updated to reflect “UI” or “PP” or if the Inventory Value is removed for Nursery and NVS, the System will remove the HIP-WI detail line. |

| • | If values for any of the other fields listed below are changed on the MPCI parent detail line, the system should update the HIP-WI child line to match. |

| • | If the underlying policy removes SCO/STAX due to ARC/PLC enrollment after SCD, the HIP-WI Endorsement amount will not increase on those acres. |

| • | If the underlying policy includes SCO, the Hurricane Protection Amount will not increase if the insured elects the ARC program on some or all of the acres insured under SCO. |

Plans 01, 02, 03, 50 (Excluding Nursery & NVS), 55, and 90 (Cat B & Cat C)

| a. | Unit Number: This value is copied from the underlying MPCI detail line and a “Related to Primary” indicator displays to the right of the number in red text. |

| b. | Detail Line Options: The options elected on the underlying MPCI and the HIP-WI. |

NOTE: SR, for short rate, does not display here as SR is not allowed on the P11 record.

| c. | Additional Options: “HIP” is displayed. |

| d. | Expected Commodity Value: Calculated as Underlying Liability Amount / (Base Coverage Level Percent * Price Election Percent). |

| e. | Total Guarantee: Calculated as Expected Commodity Value * Coverage Range. |

| f. | Hurricane Protection Amount (HPA): Calculated as Total Guarantee * Price Election Percent. |

| g. | Total Premium: Calculated as Preliminary Total Premium Amount * Multiple Commodity Adjustment Factor. |

NOTE: If the Type or Practice on the parent line is not found in the Insurance Offer ADM for the HIP Plan (37), then the System will create the HIP child line but apply a non-premium acreage code of "S", and if a non-premium acreage code of "S" is applied, the system will set to subsidy amount to blank.

| h. | Producer Premium: Calculated as Total Premium Amount - Subsidy Amount. |

Other fields were copied from the parent detail line (underlying MPCI line) and display as read-only.

NOTE: Uninsurable & Prevented Planting will always display as “No” since they are not allowed with the HIP-WI Endorsement.

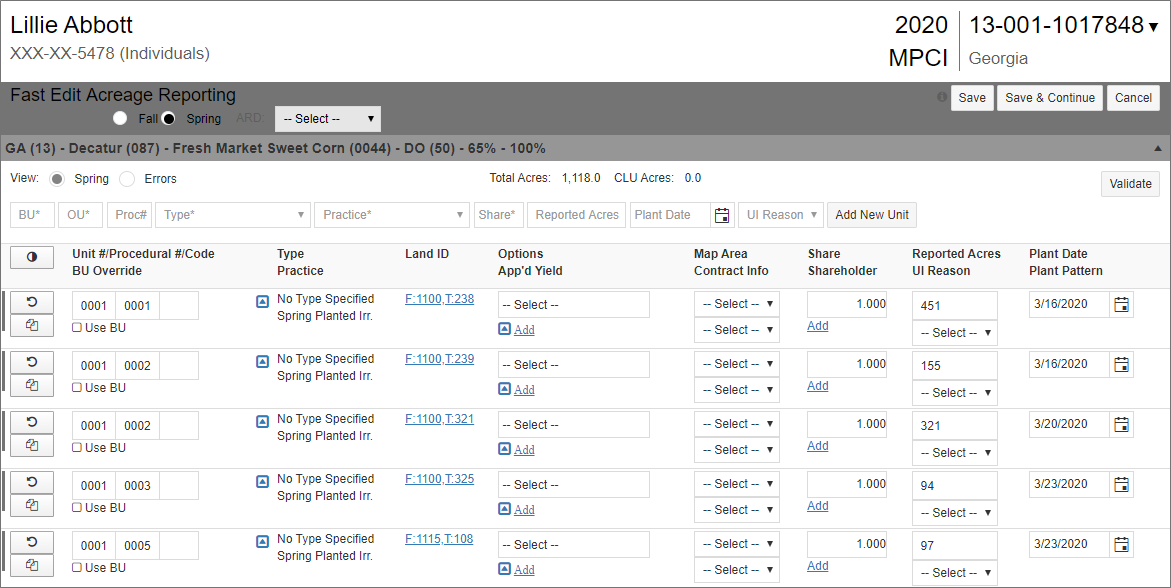

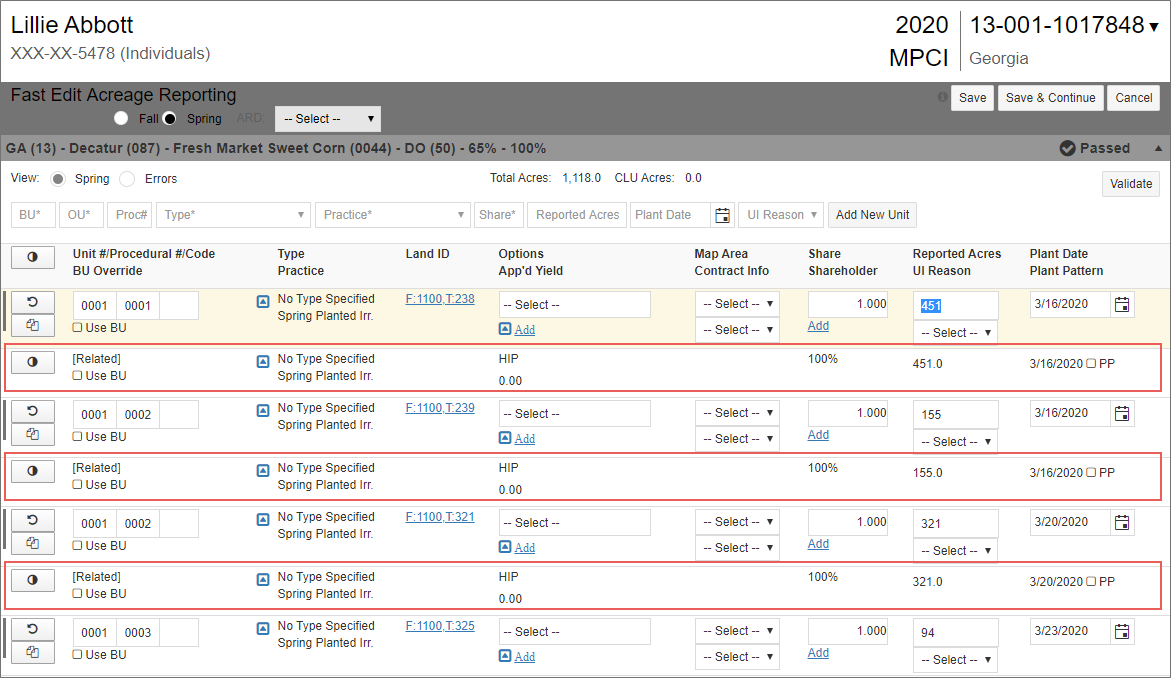

When keying acres in Fast Edit AR, the Fast Edit AR will display all detail lines that exist for the selected coverage(s), planting season, and Acreage Reporting Date. On save of acreage, the System will create the HIP-WI detail lines (child lines) as applicable in read-only format, with "[Related]" in the Unit # field and "HIP" in the Options field.

Above, the Fast Edit AR page before acres were keyed and saved. Below, after acreage was saved, the System created and displayed a child line for each parent.

This is only applicable to plans supported by the Fast Edit AR & HIP-WI: Plans 01, 02, 03, 55, and 90 (Cat B) Commodities.

The HIP-WI Endorsement does not require an Acreage Report—coverage is based upon the planted, insurable acres of the underlying MPCI coverage (no Prevented Plant or Replant acres).

The availability of Written Agreements with HIP-WI is dependent upon the actuarial documents for the underlying coverage’s crop/county:

| • | When the HIP-WI Endorsement is not provided in the actuarial documents for the crop/county, Written Agreements are not authorized to be added to an underlying policy with the the HIP-WI Endorsement to an underlying policy. |

| • | However, if the HIP-WI Endorsement is available on the actuarial documents for the crop/county where the crop is physically located, the HIP-WI Endorsement may be elected when a WA applies to the underlying policy. |

Excluding HIP on WA

A Written Agreement cannot be requested for the Hurricane Insurance Protection (HIP) in a State/County where it is not offered in the standard actuarials. However, an approved and accepted WA requested for an underlying MPCI coverage may be applicable to the HIP coverage.

As such, the WA functionality that was already in place for MPCI (including SCO) has been extended to include the associated HIP endorsement, when elected on the MPCI coverage and when the approved and accepted WA allows. .

If HIP is elected on an active MPCI coverage and a user adds a Written Agreement via the Utilities tab or coverage page, then:

| • | If the underlying Plan Code is available with HIP, coverages will not populate in the Requested Crop dropdown or in the Requested Plan dropdown on the Add New and Maintain Written Agreement pages. |

| • | HIP will not populate in the Reference Option dropdown on the Add New and Maintain Written Agreement pages or the Option Code dropdown on the Add New/Maintain WA Detail Line page. |

| • | Written Agreement applicable to the underlying MPCI Coverage and/or MPCI Detail Line will also be applicable to the HIP coverage and/or HIP detail line, if allowable. |

Want to learn more?

|

||