Related

Change a Prospect to an Insured

All Reinsurance Years

To change a prospect to an insured, the grower record must have a Tax ID added to it.

| 1. | In the Search bar, from the Year dropdown, select "All" and "Grower Name". |

| 2. | In the Search field, type the name or a partial name of the prospect and click Go. The System displays the results on the View Growers page. |

| 3. | Locate the prospect's name, and in the row that corresponds with the prospect, click the corresponding name hyperlink. The View Grower page opens. |

| 4. | Click Edit. The Maintain Grower page opens. |

| 5. | In the Eligibility Information section, select the Tax ID Type you are entering for the prospect. |

| 6. | In the Tax ID field, type the Tax ID number of the Tax ID Type selected in step 5. Typing a Tax ID in the field will remove the checkmark from the Is Prospective Grower checkbox. |

NOTE: If the grower has requested a Tax ID but has not received a number, mark the W-9 Received checkbox to indicate that they've provided a copy of the W-9 request.

| 7. | In the Grower Information section, complete any remaining, necessary information about the prospect. |

| 8. | To save or discard your changes, do one or more of the following: |

| • | To save changes to the grower record but stay on the page, click Save. |

| • | To save changes to the grower record and return to the View Growers search results page, click Save & Exit. |

| • | To discard your changes and return to the View Growers search results page, click Cancel. |

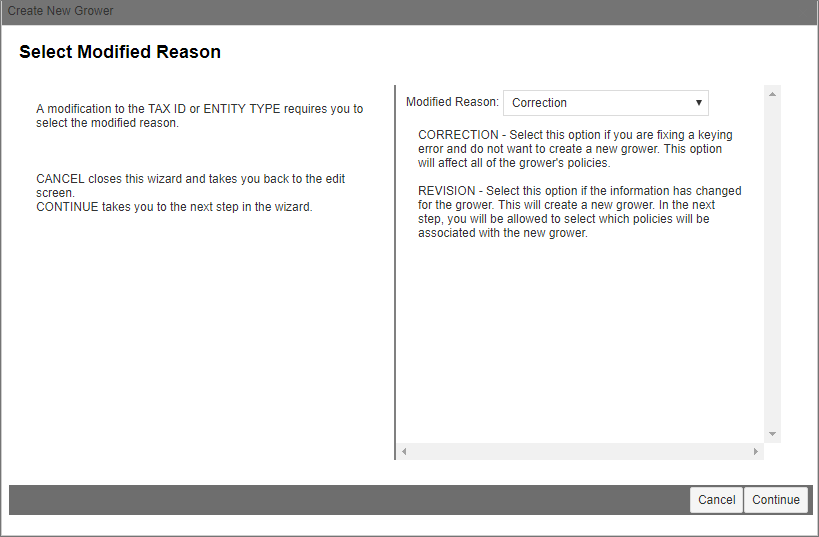

| 9. | If you selected Save or Save & Exit in step 8, the Create New Grower popup opens and prompts you to select a reason for the modification. From the Modified Reason dropdown, select "Correction". A confirmation page displays. |

|

| 10. | Click Save & Close. You are returned to the Maintain Grower page. |

| 11. | Click Save & Exit to return to the View Grower for Policy page. |